How We Buy Houses in Chicago Works | Complete Process Guide

Table of Contents

✓ How the "We Buy Houses" Process Works

✓ What "We Buy Houses" Actually Means

✓ Why Chicago Homeowners Choose Cash Buyers

✓ How to Spot Legitimate Buyers (Red Flags vs. Green Flags)

✓ What You'll Actually Receive (Real Numbers)

✓ Chicago-Specific Rules You Must Know

✓ Is This Right for You? (Honest Pros and Cons)

✓ Frequently Asked Questions

Seen 'We Buy Houses' signs around Chicago—in Englewood, Bridgeport, or Logan Square? Wondering if these companies are legitimate or if selling your house for cash actually works?

We buy houses Chicago homeowners need to sell fast—in any condition, any situation. This guide explains exactly how cash home buyers work, what you can expect step-by-step, and whether this option makes sense for your situation.

You'll learn the complete 5-step process, how to spot legitimate buyers, what you'll actually receive in cash, and Chicago-specific rules that affect your sale.

Ready to see what your house is worth? Get your free cash offer today.

How the "We Buy Houses" Process Works

1. Initial Contact (Day 1)

You share your property address, condition, and timeline via phone or online form. No obligation.

2. Property Walkthrough (Day 1–2)

We visit your house within 24–48 hours. No repairs needed—we assess as-is condition.

3. Receive Cash Offer (Day 2–3)

You get a written, no-obligation offer within 24 hours based on comparable sales, repair costs, and current market conditions.

4. Accept and Schedule Closing (Day 3)

If you accept, you choose your closing date—7 days to 60 days, whatever works for you.

5. Close and Get Paid (Day 7–60)

Sign final papers at a Chicago title company. Receive payment via wire transfer or cashier's check the same day.

See if this timeline works for you—get your free evaluation now.

What "We Buy Houses" Actually Means

"We Buy Houses" companies are direct investors who purchase properties for cash. We're not real estate agents or brokers. We don't list your house or find you a buyer. We are the buyer.

Our business model is straightforward. We buy properties, renovate them, and either rent them long-term or sell them retail. We make money by adding value through renovations—not by taking advantage of sellers.

We buy houses in as-is condition. You don't spend a dollar on repairs. That leaking roof, cracked foundation, or outdated kitchen from the 1970s—we handle all of it.

Dello Investments has been purchasing Chicago properties since 2021 across all neighborhoods—from Lincoln Park to Calumet City, North Lawndale to Chatham.

Now that you understand what cash buyers do, let's talk about why Chicago homeowners choose this option.

Why Chicago Homeowners Sell for Cash

Chicago homeowners choose cash sales when speed, convenience, or property condition make traditional sales difficult or impossible.

Common scenarios we see:

Facing foreclosure — Need to sell before auction date

Inherited property — Out-of-state heirs, probate complications, deferred maintenance

Major repairs needed — Foundation issues, roof damage, outdated systems

Job relocation — Moving within 30 days, can't wait for traditional sale

Behind on property taxes or liens — Need immediate resolution

Tired landlords — Problem tenants, maintenance headaches, ready to exit

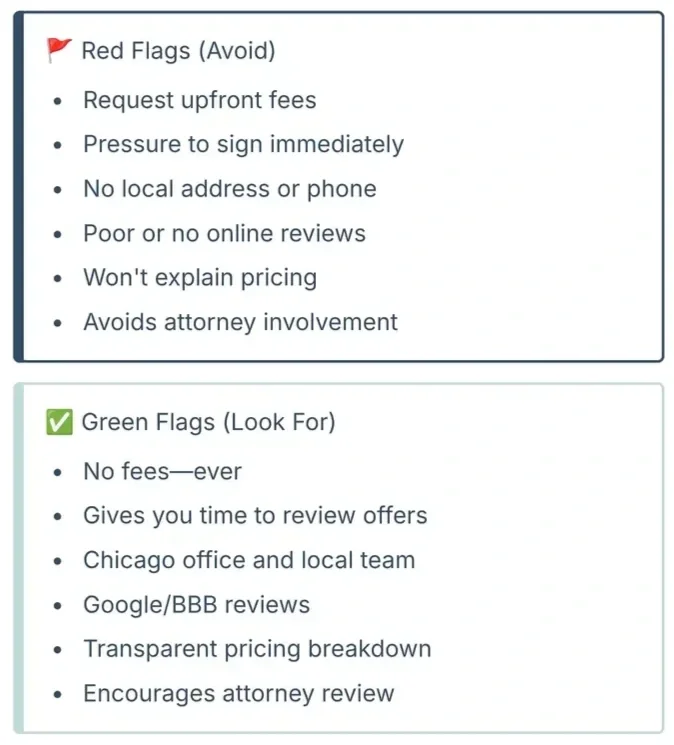

How to Spot Legitimate Cash Buyers (and Avoid Scams)

Most cash buyers in Chicago are legitimate, but skepticism protects you.

The real estate investment industry includes professional companies and bad actors. Knowing the difference keeps you safe.

How to vet a cash buyer:

Check Google and BBB reviews (look for 4+ stars, recent reviews)

Verify Illinois business registration (Secretary of State website)

Ask for local references (recent Chicago sellers)

Have your attorney review any contract before signing

Dello Investments maintains a 4.8-star rating on Google. We encourage all sellers to have their attorney review our purchase agreement—at no cost to you.

Once you've confirmed legitimacy, the next question is: What will you actually receive?

What You'll Actually Receive (Real Numbers)

Cash offers are lower than retail value. Here's why, and here's the exact math.

Our Pricing Formula:

After Repair Value (ARV)

- Estimated Repair Costs

- Holding Costs (taxes, insurance, utilities)

- Closing Costs (buying + selling)

- Our Profit Margin (15-20%)

= Your Cash OfferReal Dello Example: Calumet City Bungalow on 155th Street

Property: 3-bed/2-bath brick bungalow in Calumet City (purchased from Robert in 2022)

Our Purchase Price (Cash to Seller): $90,000

Our Investment Breakdown:

Purchase price: $90,000

Renovation costs: $30,000

Closing costs (buying): $3,000

Holding costs during rehab (3 months): $2,500

Total investment: $125,500

Refinance Details:

Loan amount: $120,000 (30-year mortgage)

Appraised value after renovation: $155,000

Current rental income: $1,400/month (same tenant since late 2022)

Why This Strategy Works (BRRRR Method):

Buy cash at below-market price

Renovate to rental-ready condition

Rent to quality tenant

Refinance to pull capital back out

Repeat process with next property

What Robert (The Seller) Received:

$90,000 cash in 30 days

No repairs required

No real estate commissions

No closing costs (we paid them)

Avoided 6+ months of traditional sale process

Traditional Sale Comparison (If Robert Listed):

Estimated list price: $125,000 (as-is condition)

Agent commissions (6%): -$7,500

Seller closing costs: -$2,500

Time on market: 90-120 days

Net proceeds: ~$115,000 after 3-4 months

The Trade-Off: Robert received $90,000 in 14 days with zero hassle. A traditional sale might have netted $25,000 more but required 3-4 months and $30,000 in repairs to reach full market value.

Why Our Profit Margin?

We take all the risk. If the market drops, repairs cost more than expected, the property sits vacant, or tenants damage the property, we absorb those losses. Our margin accounts for market risk, renovation overruns, holding costs, and business expenses.

We use the BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat) and traditional flips. Both require capital, expertise, and risk tolerance most homeowners don't have or want.

Now let's cover Chicago-specific rules that affect your sale.

See Photos from our Calumet City rental flip here! 👇

Chicago-Specific Rules You Must Know

Chicago and Cook County have unique regulations that affect home sales. Cash buyers handle these, but you should understand them.

1. Full Payment Certificate (FPC)

The City of Chicago requires proof all water and sewer charges are paid before deed transfer. We handle this at closing, but it can add $500-$2,000 to settlement costs if bills are outstanding.

2. Point-of-Sale Inspections (Select Areas)

Skokie, Evanston, and some Chicago wards require occupancy permits before sale. This inspection checks smoke detectors, carbon monoxide detectors, and basic safety. Adds 1–2 weeks to timeline. We coordinate these inspections.

3. Property Tax Prorations

Cook County property taxes are paid in arrears. We handle prorations at closing so you're not responsible for taxes after the sale date.

4. Title Issues (Liens, Judgments, Back Taxes)

We buy properties with liens, back taxes, and code violations. These reduce your offer price but don't prevent the sale. We pay off liens at closing.

5. Seasonal Market Factors

Winter sales (November–February) favor cash buyers. Fewer retail buyers mean less competition for your property, making cash offers more attractive.

Neighborhood Variations:

South Side (Englewood, Auburn Gresham, Chatham): Higher concentration of tax liens and deferred maintenance

West Side (Austin, North Lawndale, Garfield Park): Code violations and utility shut-offs common

South Suburbs (Calumet City, Dolton, Harvey): Strong rental demand; investors actively buying

North Side (Lincoln Square, Albany Park, Rogers Park): Stronger retail market; traditional sales may net more if property is move-in ready

We've closed in 45+ Chicago neighborhoods and Cook County suburbs. Each has unique code requirements, tax situations, and market conditions we understand.

Now that you know the rules, let's evaluate: Is this right for you?

Is This Right for You? (Honest Pros and Cons)

Cash home buying isn't right for everyone. Here's an honest assessment so you can make the best decision for your situation.

When Cash Sales Make Sense:

Facing foreclosure or short sale

Inherited property with deferred maintenance

Job relocation (need to close fast)

Behind on property taxes or have liens

Major repairs needed (roof, foundation, systems)

Tired landlord ready to exit

Divorce requiring quick asset split

When Traditional Sales Make More Sense:

Property is move-in ready

You have 6–12 months to wait

You can afford repairs and staging

Strong retail market in your neighborhood

You want maximum dollar amount (not speed)

Honest Assessment:

We're not competing with traditional sales. We're offering a different solution for different situations. The right choice depends on your priorities: speed vs. maximum price.

Let's answer the most common questions we hear.

Frequently Asked Questions

Q: Can I negotiate the cash offer?

Most cash offers have limited negotiation room because they're based on fixed formulas (ARV minus repairs minus costs minus profit). However, if you have recent appraisals, repair estimates, or comparable sales data that suggest different values, share them. We'll review and adjust if warranted.

Q: What happens if my house has liens or back taxes?

We buy properties with liens, judgments, and back taxes regularly. These are paid off at closing from the sale proceeds. Your offer will be reduced by the lien amounts, but you walk away with the remaining equity and no debt.

Q: How do I choose between a cash buyer and a traditional realtor?

Ask yourself: Do I need speed or maximum price? Can I afford repairs? Can I wait 6–12 months? If speed and convenience matter more than squeezing every dollar, cash makes sense. If you have time and your property is in good condition, traditional sales may net more.

Q: Will selling to a cash buyer hurt my credit?

No. Selling your house (cash or traditional) doesn't affect your credit. In fact, if you're behind on mortgage payments or facing foreclosure, selling for cash can prevent the credit damage of foreclosure.

Q: Can I close on my timeline, or is the date fixed?

You choose the closing date. Need 7 days? We can do that. Need 60 days to find your next home? That works too. We're flexible because we're not dependent on mortgage approval timelines.

Q: Do you buy houses with tenants?

Yes. We buy occupied rental properties regularly. You don't need to evict tenants or wait for leases to end. We'll handle the transition with current tenants.

Q: What if I just want an offer to compare against other options?

Perfect. That's exactly what we recommend. Get our offer, talk to a realtor, explore all your options, and make the best decision for your situation. Our offers are no-obligation.

Q: How quickly can you actually close?

Our fastest closing was 5 days. Most close in 7–14 days. The timeline depends on title work (typically 3–5 days) and your schedule. If you need more time, we can extend to 30–60 days.

Q: What happens if the title search finds problems?

We handle title issues at closing. Whether it's liens, judgments, or ownership disputes, our title company resolves these problems. In rare cases where title can't be cleared, we'll work with you to find solutions or cancel the contract.

Q: Can you close remotely if I've moved out of state?

Yes. If you've relocated, we arrange remote closing through mobile notary or digital signing. You don't need to fly back to Chicago.

Q: Do you buy commercial properties or vacant land?

Yes. While we specialize in residential properties, we also buy multi-unit buildings, mixed-use properties, and vacant land in Chicago and Cook County. Contact us to discuss your specific property.

Ready to Move Forward?

Get your transparent cash offer with complete pricing breakdown.

Call Us: (312) 975-5557 — Speak with a real person today. Available 7 days/week.

Get Your Online Offer: Fill out our 1-minute form and we'll contact you within a few hours.

Email Us: connect@dello-investments.com — We respond same day.

★★★★★ 5/5 Google Rating | Purchasing Chicago Homes Since 2021

About Dello Investments

Woman, Veteran & Latine-Owned

Alexa and Karen, Managing Partners

We're a Chicago-based real estate investment company helping homeowners sell properties quickly and fairly since 2021. We're not a franchise or national company—we're your neighbors, invested in this community.

Our Promise:

Fair offers. Transparent pricing. Zero hassles.

Chicago Neighborhoods We Serve

North Side:

Lincoln Park | Lakeview | Lincoln Square | Rogers Park | Uptown | Edgewater | Ravenswood | Albany Park | North Center | Avondale

Northwest Side:

Jefferson Park | Portage Park | Irving Park | Dunning | Belmont Cragin | Hermosa

West Side:

Austin | Humboldt Park | West Town | Garfield Park | North Lawndale

South Side:

Hyde Park | Bronzeville | Bridgeport | Pilsen | Englewood | Chatham | South Shore | Auburn Gresham | Roseland

Southwest Side:

Brighton Park | Archer Heights | Gage Park | Chicago Lawn | Ashburn

Cook County Suburbs:

Cicero | Berwyn | Oak Park | Maywood | Skokie | Evanston | Naperville | Schaumburg | Calumet City | Dolton